SREP – the supervisory review and evaluation process

One of the key tasks of banking supervision is to ensure the sustained viability of credit institutions. To ensure their long-term viability, banks need above all:

- an effective business model

- adequate risk management systems

- a solid capital base, and

- adequate liquidity and stable refinancing patterns

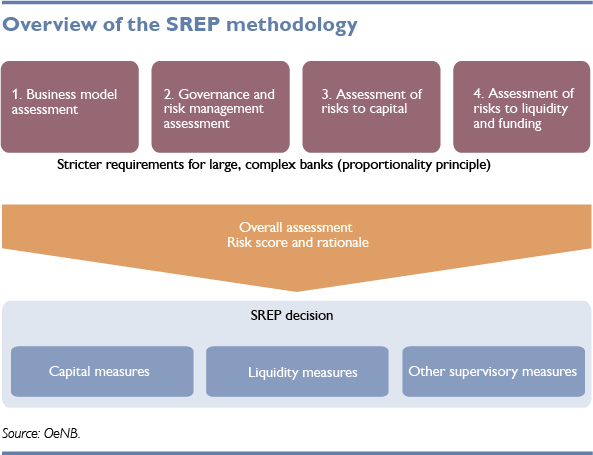

The annual supervisory review and evaluation process (SREP) has been designed to look into those four major aspects. Based on common guidelines the European Banking Authority (EBA) has provided for all EU-based supervisory authorities and on SREP methodologies applicable within the SSM, the OeNB analyzes Austrian banks in detailed SREP reviews in cooperation with the Financial Market Authority (FMA) and the European Central Bank (ECB). In line with the size and complexity of banks, the respective findings are integrated into an overall assessment, which then informs supervisory measures to be taken by the competent authorities.

The supervisory authorities may impose capital or liquidity requirements that go beyond the minimum requirements or address deficiencies in other areas. The specific requirements are communicated in the form of FMA or ECB decisions. Key analysis outcomes also inform the off-site analysis of banks and the planning process. Reviewing compliance with and implementation of the measures imposed is also an integral part of the SREP.

What issues does the SREP address?

1 Analysis of the business model covers, among other things, a bank’s core business, its economic environment and its financial plan. The focus of analysis is on adequate profitability as well as on the sustainability of the business model, with a view to ensuring that banks will stand ready to meet potential or existing capital shortfalls without external aid. If the SREP review shows that the existing business model is deficient or that restructuring plans may aggravate a bank’s financial situation, possible recovery measures will be discussed with the bank and imposed as necessary.

2 The assessment of governance issues seeks to establish whether the risk management function is sufficiently segregated, operationally independent, adequately staffed and qualified, whether internal audits have been implemented as required, and whether remuneration policies and practices comply with the legal requirements. Moreover, the reviews focus on whether banks’ internal processes are adequate in view of the complexity of their operations. For instance, there must be mechanisms in place to ensure that the senior management can take informed decisions in a timely manner. In the case of less significant banks, governance issues are reviewed by the FMA.

3 The third part deals with evaluating whether the risks banks incur may lead to losses and whether banks have sufficient capital to absorb these losses. Specifically, the SREP verifies whether all risks have been identified, measured and backed with adequate capital.

Austrian banks primarily face credit risks, essentially the risk that private and commercial borrowers may unexpectedly fail to pay back their loans. Other risks include policy rate and market price changes, currency fluctuations, IT risks and legal risks, etc. As a rule, riskier transactions will entail higher capital requirements than less risky transactions, such as banks’ traditional and generally well collateralized lending business. At the same time, weak control mechanisms for existing risks or inadequate risk management processes may also entail weaker scores and hence higher capital requirements.

Within the SREP framework, supervisors check banks’ self-assessment against regulatory requirements and assess whether banks’ own risk assessment is complete and adequately conservative. Supervisors perform plausibility checks and assess estimated amounts and possible future challenges and cross-check banks’ calculations against supervisory calculation methods. Moreover, supervisors take into account other relevant inputs and potential deficiencies established through on-site analysis or derived from other sources.

In this vein, supervisors verify all types of risk in detail and report identified weaknesses back to banks. As data plausibility is also checked during the SREP process, this makes it possible to identify any deficiencies with regard to the quality of the underlying data. Last but not least supervisors run stress tests for a multi-year horizon with a view to identifying bank-specific vulnerabilities. It is then up to the individual banks to develop adequate countermeasures and ensure adequate capitalization.

4 Similarly to the assessment of risks to capital, supervisors analyze risks to banks’ liquidity and funding which may render them unable to meet their payment obligations in a timely manner. These assessments address both excess liquidity over short-term horizons as well as long-term funding plans. In addition, supervisors assess the outcome of stress tests to make sure that banks will have enough liquidity even under more adverse external conditions. One way to ensure this is to require banks to invest excess liquidity over short-term horizons, to enable them to respond swiftly to changes in the business environment.

What are the possible outcomes of the overall SREP assessment?

Finally, the individual assessments are added up to an overall assessment and translated into scores.

As the final step in the SREP process, the FMA or the ECB will issue a decision spelling out the capital requirements established for the bank at hand. In case the capital base was found to be inadequate, banks will have to build up capital. Banks may, moreover, be required to improve their liquidity situation beyond the minimum regulatory requirements, or they may be required to remedy identified deficiencies. Together, these measures are intended to ensure that banks will be sufficiently resilient even under adverse business conditions, thus contributing to the maintenance of financial stability. Following up on the SREP process, supervisors will monitor banks’ compliance with the requirements and measures detailed in the SREP decisions in the process of off-site analysis and, if required, through on-site inspections.

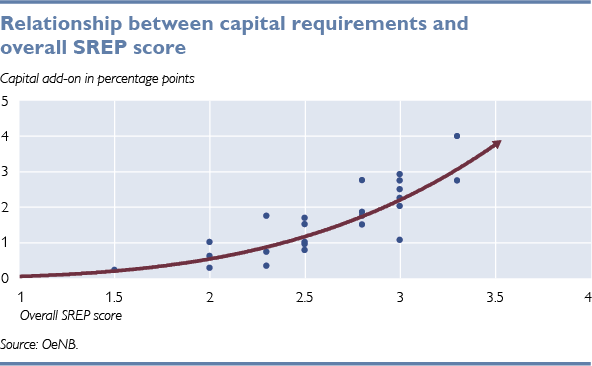

To sum it up, the key outcomes of the SREP process are the overall SREP score assigned to the supervised banks and the capital add-on they are required to hold beyond regulatory own funds. Using the SREP assessments made in 2016, the chart below illustrates the relationship between SREP scores and the resulting capital requirements defined for the significant and less significant banks operating in Austria.