IBAN and BIC

Payment orders issued in the Single Euro Payments Area (SEPA) use international information, i.e. the IBAN, the International Bank Account Number, and the BIC, the Business Identifier Code, rather than national bank account numbers and bank identifiers.

IBAN

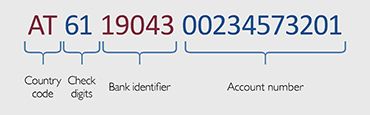

The IBAN – the International Bank Account Number – uniquely identifies an individual account at a specific financial institution in a particular country, thus making all accounts within SEPA reachable. It combines bank codes and account numbers according to the method defined by each SEPA country’s domestic numbering scheme. Since August 1, 2014 payment orders can even within Austria only be initiated with the IBAN. Since February 1, 2016, customers are no longer obliged to state the BIC for cross-border payment transactions in Euro within the European Economic Area; statement of the BIC for cross-border payments in Euro within the EU will no longer be necessary.

For most countries, the IBAN format combines bank account numbers and national bank identifiers, complemented by a country code (AT for Austria) and two check digits. The check digits help prevent money transfer errors, as they allow sending banks to perform sanity checks of the beneficiaries’ account numbers before actually making transfers. The length of the IBAN differs from country to country, depending on how many characters the respective countries’ account numbers and bank codes have, and whether the countries additionally use branch codes and/or national check digits. All Austrian IBANs have 20 characters.

Your IBAN is shown on your account statements, bank card or debit card, and in the online banking platform of your bank. Look for the IBAN either on the front or the back of your card. As the use of the IBAN and BIC will be mandatory in the euro as of August 2014, you will need the IBAN and BIC of the payment recipient if you wish to make a payment. Just like now, it is up to the recipient to provide you with these codes. Look for a payment recipient’s IBAN and the BIC of the recipient’s bank e.g. on bills. Do not try to deduct a recipient’s IBAN on the basis of incomplete information. Incorrect IBANs may result in delays and extra costs that the bank will charge its customers.

BIC

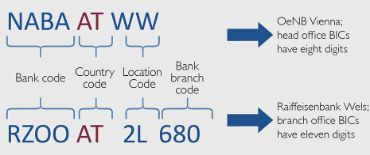

The BIC (Business Identifier Code, also known as SWIFT code) is a unique international identification code for financial institutions. The BIC identifies a credit institution, whereas the IBAN identifies an account held with a bank. The BIC is the international counterpart e.g. of the Austrian bank code, the “Bankleitzahl.” Since February 1, 2016, customers are no longer obliged to state the BIC for cross-border payment transactions in Euro within the European Economic Area.

The BICs consists of 8 or 11 alphanumeric characters.

You will find your bank’s BIC on your account statements, bank or debit card, in the online banking platform of your bank or in the BIC Directory of SWIFT, the Society for Worldwide Interbank Financial Telecommunication.