Foreign direct investment

Outward direct investment

Inward direct investment

Concepts and components

Foreign direct investment (FDI) is a category of long-term cross-border investment in corporations. Investments in foreign companies only qualify as FDI if a minimum equity share of 10% is acquired. Investments below this threshold are classified either as “portfolio investment” or “other investment”.

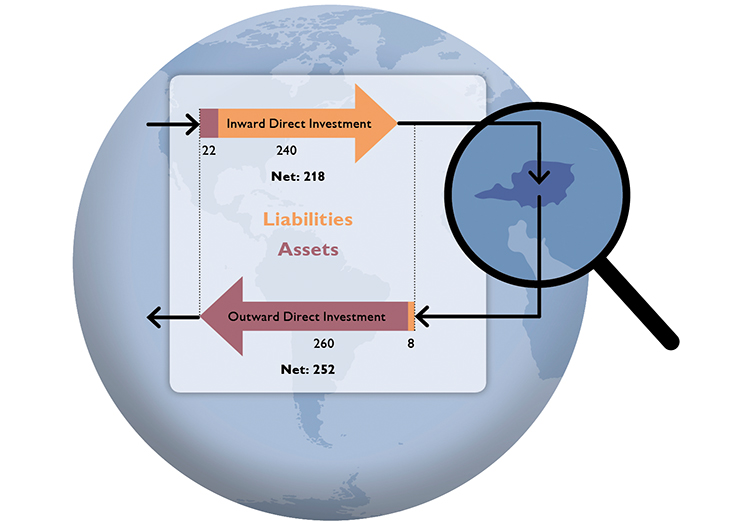

The main categories of FDI are defined in terms of the direction of the investment: “Outward direct investment” (ODI) refers to a domestic investor’s activities abroad. “Inward direct investment” (IDI) refers to activities of foreign investors in domestic enterprises. Usually, financial assets flow from direct investors to direct investment enterprises in the form of equity subsidies or intra-company loans. Therefore ODIs are primarily claims held by resident investors on their enterprises abroad, while IDIs mainly translate into liabilities of resident corporations vis-à-vis their foreign investors.

However, there are cases when funds are channeled in the opposite direction, and loans are granted e.g. from an Italian subsidiary to its Austrian parent company. These cases of “reverse investment” reduce the overall amount of ODI or IDI. Direct investment therefore is expressed as a net figure: In the case of ODI, the net figure represents claims minus liabilities, while IDI is calculated by subtracting claims from liabilities.

In related statistics like the balance of payments, international investment position or financial accounts, FDI is presented somewhat differently, i.e. in line with the asset/liability principle. This means that FDI is broken down into the main categories “claims” and “liabilities,” regardless of its direction (ODI or IDI). Furthermore, real estate and special purpose entities (SPEs) are included in this presentation of FDI.

| Assets abroad | 282 |

| Liabilities abroad | 248 |

Standard breakdowns of ODI and IDI are by industry and by region.