Key stakeholders in card payments

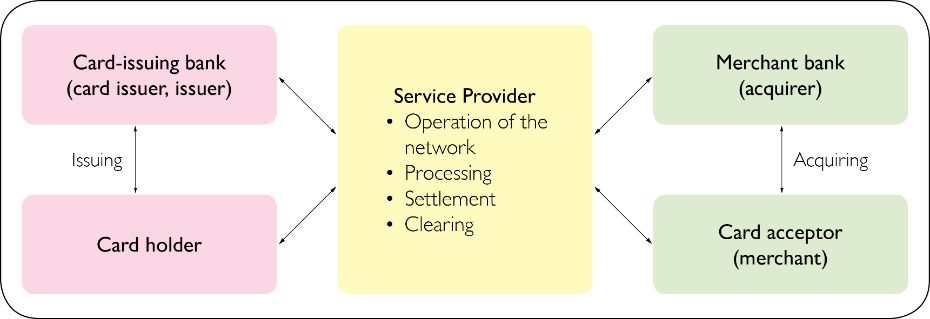

Card payment transactions involve a number of stakeholders offering particular services. The relationships between these stakeholders are highly standardized.

Cardholders are persons to whom a payment card is issued and who are authorized to use that card.

Card-issuing institutions (= issuers) issue debit or credit cards to cardholders. Most cards in Austria are issued by the prospective cardholder’s bank.

Wholesalers or retailers of goods and/or services seek authorization from an issuer to accept card payments. Once the issuer enters into such a contractual relation with, a retailer, for example, this retailer becomes a card-accepting merchant and the issuer performs the role of an acquirer offering specific services to the merchant. In Austria, many players offer acquiring services; as a rule, processing, i.e. handling the technical aspects of card transactions, is done by payment service providers.

Service providers supply the technical infrastructure (network operation) and the facilities needed to process, settle and clear card transactions.

Issuers, acquirers and service providers need a set of rules to ensure interoperability. National and international card scheme owners define the rules and standards for operating card schemes; they issue rulebooks and provide global networks.

Licenses

National card issuers like commercial banks may be linked directly to an international card scheme owner, making them a principal member, or they may be connected indirectly as an affiliate member.

Principal membership

National card issuers connected directly with an international card scheme owner are principal members and as such have the right to issue cards and to acquire merchants. . By becoming a principal member, the national card issuer undertakes to respect the rules and regulations of the respective international card scheme owner, but is free to operate within the scope of these rules.

Affiliate membership

An affiliate member participates indirectly in the activity of the international card scheme owner through the sponsorship of a principal member. Affiliate members are subject to the governance and supervision of the principal member in all areas related to card issuing, and affiliate members’ plans and their execution are subject to the approval of the principal member.

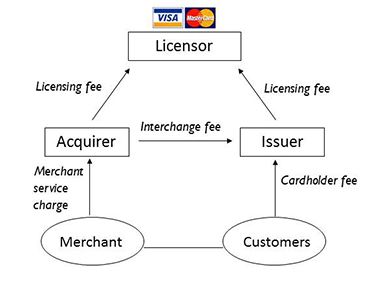

Four-party versus three-party scheme

The differences between the two schemes are briefly explained below.

Four-party scheme

The following fees typically apply in a four-party scheme:

- Merchant service charges (MSCs): The merchant pays the acquirer a merchant service charge, which, as a rule, is a percentage of the merchant’s transaction amount. The acquirer passes on part of the MSC to the issuing institution.

- Interchange fees: The acquiring institution generally pays the issuing institution an interchange fee, which is a percentage of the payment card transaction of a merchant. Note, however, that for payment card transactions at the point of sale, the issuer pays the acquirer an interchange fee, as the latter provides the payment infrastructure.

- Generally, interchange fees can be negotiated bilaterally or multilaterally. If two banks have not concluded an agreement, the fallback rate of the respective card scheme owner applies.

Arguments to justify the need for an interchange fee include the following:

- The issuer guarantees the payment. This is done a) through an online request to the issuer (referred to in Austria as OLI). Such a request to the card-issuing bank is made to determine whether the customer’s account has sufficient liquid funds to cover the payment or whether the amount exceeds any overdraft limit: b) by establishing an overdraft limit.

- Therefore, the issuer bears the bulk of the risk (of default, fraud, cost of fraud prevention).

- The issuer pays the processing costs.

- The interest-free period (the time before the cardholder’s account is actually debited) involves costs.

- The issuer invests in international measures to create incentives to accept cards.

- The issuer helps fund innovations for new payment forms and improved security technology.

- Cardholder fees: Issuers charge cardholders various types of fees, such as annual fees.

- Licensing fee: Issuers and acquirers pay card scheme owners a licensing fee.

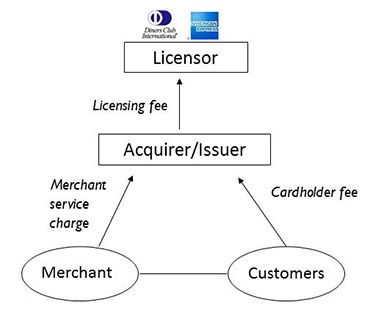

Three-party scheme

In a three-party scheme, the institution that issues cards also acts as acquirer. There is therefore no need for an interchange fee , but all other fees, i.e. the merchant service charge, the cardholder fee and the licensing fee, apply also to the three-party scheme.

See the Federal Economic Chamber’s website for information in German about credit card companies’ currently applicable fees and services.