Gold reserves

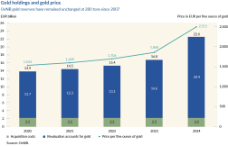

Following regular reviews of its gold storage policy, the OeNB has readjusted this policy to the effect that half of Austria’s gold reserves totaling 280 tons are to be stored domestically. In line with the revised policy, 90 tons of gold were thus repatriated in the summer of 2018. Now, 140 tons of gold are stored in Austria, 90 tons in the OeNB’s own vaults and 50 tons in the vaults of one of the OeNB’s subsidiaries, Münze Österreich AG. The gold holdings kept in storage by the OeNB comprise around 7,200 gold bars, while Austria’s total gold reserves of 280 tons correspond to some 22,400 gold bars.

By 2020*, the 140 tons remaining in custodian storage abroad will be divided between the U.K. (84 tons) and Switzerland (56 tons). Using different storage locations helps the OeNB reduce concentration risk and allows the use of gold in the London and Zurich gold markets should the need arise.

* The relocation has been postponed until organizational and logistical obstacles have been resolved.

Gold has traditionally served, and continues to serve, as an important store of value, allowing central banks to diversify their reserve assets. Hence, gold also represents a key reserve asset for the OeNB. The gold held by all euro area central banks combined is part of the Eurosystem’s reserve assets and thus helps stabilize the euro. In terms of the Eurosystem’s overall gold reserves, the OeNB’s current gold holdings roughly correspond to the OeNB’s share of the ECB’s capital. From a monetary policy perspective, the volume of gold held by the OeNB is deemed to be appropriate relative to the size of both its total reserve assets and the Austrian economy.

Development and importance of gold reserves in Austria

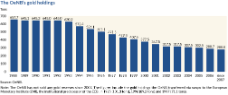

Of the 78.2 tons of gold confiscated by the Deutsche Reichsbank in 1938, 50.1 tons were restituted after World War II. In the 1950s and 1960s, Austria’s gold holdings increased significantly due to the country’s rapid economic recovery in the post-war period, peaking at some 657 tons in the 1980s. As in the past, the OeNB continues to store a portion of its gold reserves abroad because, in the event of a crisis, gold can only be used effectively in international gold trading centers. Moreover, during the Cold War, geopolitical considerations had come into play as well.

Up to the early 1970s, gold reserves had been essential for central banks in maintaining gold parity. However, after the 1973 collapse of the Bretton Woods system, gold was no longer backing the currency in circulation and thus lost in importance. The introduction of the euro as a noncash currency in 1999 further reduced the Eurosystem’s need to use its gold reserves to smooth out exchange rate movements of other European currencies.

In the 1990s, the OeNB’s gold holdings decreased, as around 22 tons were put into custody with the ECB and, in addition to that, the OeNB sold part of its gold. Since 2007, the OeNB’s gold reserves have remained unchanged at 280 tons.

The countries with the largest gold reserves are the United States of America (some 8,133 tons), Germany (some 3,381 tons), and Italy (some 2,452 tons). The gold reserves held by the Eurosystem as a whole amount to about 10,789 tons.

Gold as a reserve asset

Many central banks keep gold in storage as a reserve asset, with gold bars symbolizing stability.

The gold bars held by central banks as reserve assets must meet the Good Delivery Rules of the London Bullion Market Association specifying, for instance, the dimensions, weight and fineness of a gold bar. The minimum acceptable fineness, which determines a gold bar’s actual gold content, must be 995.0 parts per thousand fine gold. Furthermore, Good Delivery gold bars must have a serial number and the assay stamp of the certified refiner. The gold bars that were returned to the OeNB weigh about 12.5 kg each and are about 25 cm long, about 7 cm wide and about 4 cm high. Each gold bar and its specifications are documented in a gold bar list.

Verifying the authenticity of gold

As with most things of great value, there have been repeated attempts to counterfeit gold bars. The method has remained more or less unchanged over time. In most cases, counterfeiters use inferior metals, such as iron or tungsten, to produce the core of the bar, which is then coated in a layer of gold. Therefore, subjecting gold bars merely to an external check proves insufficient to verify their authenticity.

Each of the OeNB’s gold bars transported to Austria was checked for authenticity. The weight of the gold bars was measured with high-precision scales, ultrasonic devices were used to check their cores and x-ray fluorescence tests served to determine the fineness of the gold.

Gold market

London, Zurich and New York continue to be the most important gold trading centers. Gold prices are typically quoted in U.S. dollars per troy ounce (1 ounce = 31.103 g).

The price of gold is determined by supply and demand. More specifically, gold prices are primarily driven by the demand of the jewelry industry and the electrical industry as well as investors’ propensity to buy gold bars and coins. Likewise, gold sales and purchases conducted by central banks leave their mark on gold prices. The price of gold is set twice daily (at 10:30 a.m. and 3:00 p.m.) in London during the London Bullion Market Association’s gold price auction.

Central Bank Gold Agreement (CBGA)

In July 2019, the European Central Bank (ECB) and the 21 other central banks that are signatories of the Central Bank Gold Agreement (CBGA) decided not to renew the agreement upon its expiry on September 26, 2019. Central banks first signed the CBGA in 1999 to coordinate their gold sales, with the resulting transparency contributing to balanced conditions in the gold market. As liquidity and investor behavior in the market have changed since 1999 and the gold price has risen considerably, the signatories have decided not to renew the agreement for another five years. The central banks continue to see gold as an important component of their reserve assets and do not currently have plans to sell significant amounts.

Press release of the ECB, July 26, 2019.