On-site inspections and internal model investigations

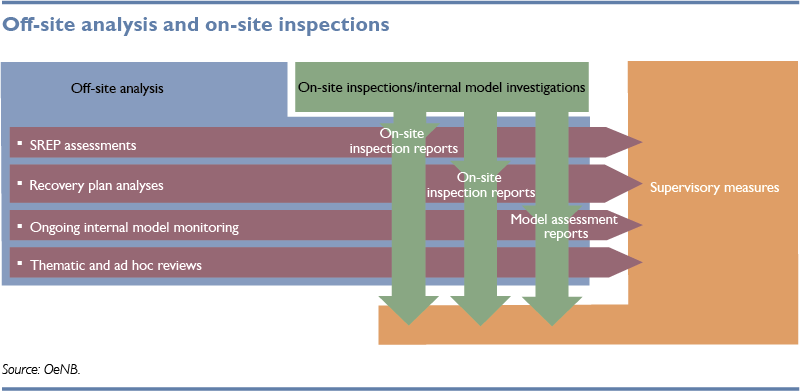

To arrive at a comprehensive assessment of banks, supervisors complement off-site analysis with on-site analysis. In Austria, the OeNB is in charge of performing on-site inspections, acting on behalf of the ECB in the case of significant institutions (SIs) – which have been subject to direct supervision by the ECB since the Single Supervisory Mechanism (SSM) became fully operational in November 2014. In the case of less significant institutions (LSIs), the OeNB continues to act on behalf of the Financial Market Authority (FMA). The findings gained from on-site inspections provide the starting point for official action taken by the ECB and the FMA. The OeNB performs two kinds of on-site inspections:

- on-site inspections commissioned by the ECB or the FMA and

- on-site investigations of internal models

On-site inspections commissioned by the ECB or the FMA cover the detailed review of the risk management systems and processes used by particular business and risk areas within banks as well as sample checks of individual transactions, such as loan files. The purpose of on-site investigations of internal models is to assess whether banks meet the prerequisites for calculating their capital requirements with internal models. Approved internal risk models are used above all in the areas of credit and market risk. Applications for model approval are to be submitted to the ECB or the FMA; following investigation of the model, the OeNB will report to the ECB or the FMA whether it found the model fit for use.

Both types of inspections differ from off-site analysis insofar as they are limited to a particular time window and to a particular area that is subjected to in-depth investigation by an independent team, typically, at the bank’s premises.

Given the strong presence of Austrian banks in Central, Eastern and Southeastern Europe (CESEE), the OeNB has been involved in cross-border on-site inspections for a number of years. These inspections are performed in cooperation with the competent local supervisory authorities. OeNB experts moreover contribute to on-site inspections of the parent institutions of significant Austrian banks, and they take part in SSM-wide exchanges of on-site staff – as members or as head of a mission (“mixed teams” and cross-border missions).

How are on-site inspections planned?

For Austrian SIs, the annual inspection plans are developed by the ECB in cooperation with the FMA and the OeNB. The banking supervision divisions of the OeNB are closely involved in the planning of on-site inspections and internal model investigations, as OeNB supervisory resources are needed for the on-site inspection of banks in Austria also under the SSM.

For LSIs, the annual inspection plans are developed by the FMA and the OeNB one year ahead, taking into account the applicable laws and regulations. The annual inspection plans also comprise any scheduled internal model investigations with which the OeNB has been tasked, if already known at the planning stage.

The selection of the SIs and LSIs to be included in the annual inspection plans is largely determined by risk criteria and, additionally, the systemic importance of a credit institution.

If this appears necessary, the OeNB may and must ask the FMA to broaden the scope of ongoing inspections or launch unscheduled reviews. The OeNB may also carry out on-site inspections on its own initiative if macroeconomic reasons warrant such inspections.

How do on-site inspections work?

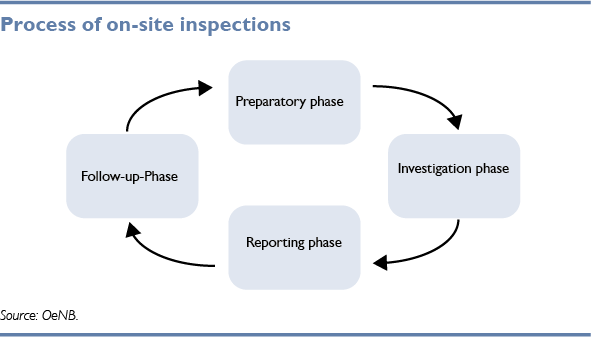

An on-site inspection commences with the ECB or the FMA issuing an inspection mandate to the OeNB that specifies the scope of examination. Unless advance notification is expected to affect the effectiveness of the review, banks are notified of upcoming inspections and contacted by the inspection team to discuss organizational details and the data and documentation to be prepared.

The OeNB’s on-site inspection team consists of a head of mission and other team members, whose number depends on the scope of inspection and the size of the bank. An on-site inspection typically involves an assessment of the relevant risk management systems and processes and the corresponding internal documentation as well as sample checks of individual transactions, such as loan cases. Depending on the size of a bank and the scope of examination, on-site inspections typically last several weeks.

Once the inspection has been completed, the bank is informed of the results in a final meeting. The findings of the on-site inspection are documented in a comprehensive report, which is submitted to the authority that requested the inspection (ECB or FMA) and the bank itself. Prior to its completion, the report is subject to an in-depth consistency check at the European and the national level with a view to ensuring a broadly harmonized approach. Banks are invited to comment on the report’s findings, with the processes differing between SIs and LSIs regarding the level of detail.

SIs receive a follow-up letter from the Joint Supervisory Team (JST) after the completion of the on-site inspection and the reporting phase. The JST remains in charge of monitoring the implementation of the required measures and recommendations which feed into an action plan. LSIs are also required to develop an action plan for remedying the identified deficiencies. Moreover, the FMA may take official action on the basis of the inspection report, the inspectors’ assessment of comments received from the bank as well as any further findings obtained from the ongoing analysis.

How do internal model investigations work?

Reviews of internal risk models are performed along the lines of on-site inspections. Internal model investigations mostly happen at the request of a credit institution and serve as the basis for model approval procedures. In some cases, internal model investigations may also be initiated by the ECB. Risk models may be applied in the following risk categories:

- credit risk (internal ratings-based approach – IRB approach)

- market risk (value-at-risk model – VaR model)

- internal models to determine exposure values in certain transactions

Once an investigation has been completed, supervisors generally draft a decision relating to the use of internal models, based on the model assessment report. If applicable, the decision may include limitations that restrict or modify the use of a model, prescribing, e.g., add-ons for certain risk parameters calculated using internal models.