FAQs on the OeNB’s financial statements

The Oesterreichische Nationalbank (OeNB) has been part of the European System of Central Banks (ESCB) and the Eurosystem from the very start; namely since 1999, when European Economic and Monetary Union (EMU) was completed with the introduction of the euro. The Eurosystem consists of the European Central Bank (ECB) and the national central banks (NCBs) of the 20 EU member states which have adopted the euro as legal tender. The Eurosystem is responsible for conducting monetary policy for the euro area. Its primary objective is to maintain price stability. Apart from its main task of defining and implementing monetary policy, the Eurosystem is responsible for a number of other tasks: conducting foreign exchange operations, promoting the smooth operation of payment systems, managing the euro area’s foreign currency reserves, issuing euro banknotes, drawing up statistics and contributing to banking supervision and to financial stability. The ESCB comprises the Eurosystem central banks plus the NCBs of the EU member states that have yet to adopt the euro.

What does the OeNB’s connection with the ECB mean for financial accounting?

The ECB is a jointly held subsidiary of the EU central banks. The OeNB’s balance sheet reflects the close relationship between the OeNB as an integral part of the Eurosystem and the ECB – above all in the item called “intra-Eurosystem balances,” which reflects the sum total of outstanding claims and liabilities among the NCBs and the ECB. In addition, the OeNB holds a share in the ECB’s capital, which equals close to 3%. This capital share entitles the OeNB to a corresponding share of the ECB’s profit distribution (for more information, see “Profits and losses of the OeNB: where do they come from?” or the following link. Finally, when Austria adopted the euro in January 1999, the OeNB transferred part of its foreign reserve assets to the ECB. The assets transferred to the ECB consisted of foreign currencies (85%) and gold (15%) (ECB: Foreign reserves and own funds).

What is the legal basis of the OeNB’s financial statements?

The OeNB draws up its financial statements pursuant to Article 67 Nationalbank Act. It must also comply with the accounting rules for ESCB central banks adopted by the Governing Council of the ECB (ECB/2024/31, as amended on November 14, 2024). And it has to consider the generally accepted accounting principles and the provisions of the Commercial Code.

Why does the OeNB’s balance sheet differ from other corporate balance sheets?

The OeNB prepares its balance sheet in the format as laid down for ESCB central banks by the Governing Council of the ECB. This format accounts for the special requirements of central banks. As a result, the OeNB’s balance sheet is only comparable with the balance sheets of other corporations to a limited extent. As a case in point, the OeNB’s assets and liabilities reflect the impact of the monetary policy measures and operations taken in the euro area. Other distinguishing features include items such as gold reserves, banknotes in circulation or intra-Eurosystem claims and liabilities.

Where can I look up figures and information on the development of the OeNB’s balance sheet and the profit and loss account?

On the OeNB’s website, you will not only find the balance sheet and profit and loss account, but also a summary of the OeNB’s most important indicators for the past five years. To download the OeNB’s balance sheets and profit and loss accounts of the past five years (including explanatory notes), go to "Financial statements". To access a variety of monetary indicators, including a monthly update of the OeNB’s financial statement, go to the statistics section and click on “OeNB, Eurosystem and monetary indicators”.

Shouldn’t the OeNB draw up consolidated financial statements?

Pursuant to Article 68 paragraph 3 Nationalbank Act, the OeNB does not have to produce consolidated financial statements. Pursuant to Article 68 paragraph 4 Nationalbank Act, equity interests are shown separately in the OeNB’s Annual Report. Hence, the respective provisions of the Commercial Code (Articles 244 through 267c) do not apply to the OeNB.

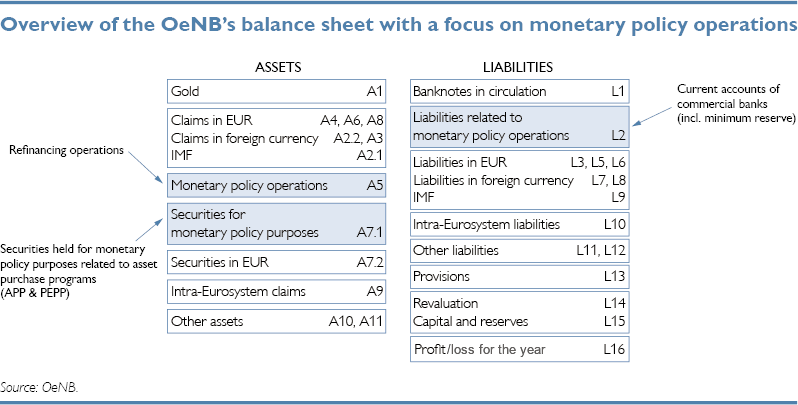

Which items does the OeNB record under assets?

The asset side of the OeNB’s balance sheet comprises all assets and claims, including the OeNB’s intra-Eurosystem claims. Asset items are grouped according to the following categories:

- Gold and gold receivables (A.1)

- Claims denominated in foreign currency (A.2 and A.3)

- Claims denominated in euro (balances and securities) (A.4 as well as A.6 and A.8)

- Monetary policy operations (A.5 and A.7)

- Intra-Eurosystem claims (A.9)

- Other assets (A.11)

Both the size and the composition of the individual asset items are largely determined by the monetary policy operations taken by the Eurosystem.

These monetary policy operations are subsumed in several balance sheet items (for details, see “What are monetary policy operations of the Eurosystem?”).

Monetary policy refers to all measures a central bank takes to meet its objectives, such as maintaining price stability. To this end, central banks use monetary policy instruments with a view to steering interest rate conditions and monetary liquidity in the markets. In the case of the OeNB, this includes, for instance, purchases of securities under the Eurosystem’s asset purchase programs as well as provision of refinancing under the Eurosystem’s main refinancing operations and longer-term refinancing operations for credit institutions.

Intra-Eurosystem balances reflect the multilateral netting of claims and liabilities in the Eurosystem. Intra-Eurosystem claims show the OeNB’s stake in the ECB and the reserve assets transferred to the ECB.

What does the OeNB record under liabilities?

The liability side of the OeNB’s balance sheet comprises banknotes in circulation, all liabilities, revaluation accounts and the OeNB’s capital and reserves. Liability items are grouped according to the following categories:

- Banknotes in circulation (L.1)

- Monetary policy operations (including credit institutions’ minimum reserves) (L.2)

- Liabilities denominated in euro and in foreign currency as well as to the IMF (L.3, L.5, L.6, L.7 and L.8 as well as L.9)

- Intra-Eurosystem liabilities (L.10)

- Other liabilities (L.11 and L.12)

- Provisions (L.13)

- Revaluation accounts as well as capital and reserves (L.14 and L.15)

- Profit/loss for the year (L.16)

The banknotes in circulation disclosed in the OeNB’s balance sheet reflect the OeNB’s share in the total value of banknotes issued by the Eurosystem. The total value of banknotes in circulation is distributed among the individual Eurosystem central banks according to a legally binding banknote allocation key, which is based on the ECB’s capital key.

The main goal of monetary policy operations is to expand or reduce monetary liquidity in the markets (for details, see “Which items does the OeNB record under assets?” and “What are monetary policy operations of the Eurosystem?”).

Intra-Eurosystem liabilities reflect multilateral netting in the Eurosystem, as mutual positions or obligations are offset among the NCBs and the ECB.

Liability item 15 Capital and reserves also includes the OeNB’s capital stock. Pursuant to Article 8 Nationalbank Act, the capital of the OeNB is EUR 12 million and is divided equally into 150,000 shares. The Republic of Austria has been the sole shareholder of the OeNB since May 27, 2010.

How does the OeNB value its assets and liabilities?

The OeNB conforms with valuation rules and accounting policies that have been harmonized by EU law and are applied by the whole European System of Central Banks (ESCB). The principles are laid down in a guideline of the ECB on the legal framework for accounting and financial reporting in the ESCB. The guideline spells out both general accounting principles and more detailed rules to ensure that assets and liabilities are valued in a harmonized way. As a rule, the OeNB values its assets and liabilities at market prices.

What are monetary policy operations of the Eurosystem?

Generally speaking, monetary policy operations are used to either expand or reduce monetary liquidity in the markets. To this effect, the Eurosystem uses a range of operations.

- Lending to euro area credit institutions related to monetary policy operations denominated in euro (A.5)

The Eurosystem uses, above all, tender operations to provide liquidity to credit institutions in the euro area. These operations may be broken down into:- main refinancing operations,

- longer-term refinancing operations,

- fine-tuning operations and structural reverse operations,

- the marginal lending facility and

- credits related to margin calls.

- Liabilities to euro area credit institutions related to monetary policy operations denominated in euro (L.2)

This item comprises current account balances of credit institutions subject to minimum reserve requirements and monetary policy instruments that absorb liquidity from credit institutions. These operations may be broken down into:- the minimum reserve system,

- the deposit facility,

- fixed-term deposits,

- fine-tuning reverse operations and

- deposits related to margin calls.

- Securities held for monetary policy purposes (A.7)

This item comprises the securities bought under the Eurosystem’s asset purchase programs. For details, see “Which asset purchase programs are reflected in the OeNB’s balance sheet?”

Which asset purchase programs are reflected in the OeNB’s balance sheet?

The securities the OeNB has been buying under the Eurosystem’s various asset purchase programs are shown under asset item 7.1 Securities held for monetary policy purposes. The following table provides an overview of the Eurosystem’s asset purchase programs:

| Start date | End date1 | |

|---|---|---|

| Securities Markets Programme (SMP) | ||

| SMP | May 2010 | September 2012 |

| Asset Purchase Programme (APP) | ||

| CBPP3 | October 2014 | June 2023 |

| ABSPP | November 2014 | June 2023 |

| PSPP | March 2015 | June 2023 |

| CSPP | June 2016 | June 2023 |

| Pandemic Emergency Purchase Programme (PEPP) | ||

| PEPP | March 2020 | December 2024 |

| 1For the SMP, the “end date” refers to the end of the program; for the APP and PEPP, it refers to the end of purchases. | ||

To learn more about the APP, please refer to the website of the ECB. For more Details about the PEPP, please refer to the website of the ECB.

Which balance sheet item reflects euro coins?

The OeNB’s year-end stock of fit euro coins is shown under asset item 11.1 Coins of euro area. This item comprises all euro coins whose intrinsic value (namely the value of the metal they were made of) is lower than their face (or nominal) value. Hence, this item captures all the commonly used euro coins. With euro coins circulating across borders, the OeNB’s stock includes euro coins issued in Austria by Münze Österreich AG and euro coins issued in other euro area countries.

Does the OeNB’s balance sheet still contain Austrian schilling banknotes and coins?

Indeed, the OeNB’s balance sheet still reflects Austrian schilling banknotes and coins that used to be legal tender until February 28, 2002.

Schilling coins:

The OeNB continues to exchange coins of the last Austrian schilling series for euro (at the exchange rate as at December 31, 1998). The schilling coins in the OeNB’s stock are shown under asset item 11.6 Sundry of the balance sheet.

The OeNB handles this exchange on behalf of, and nets its expenses with, the original coin issuers, the former Austrian State Mint (now represented by the central government) and Münze Österreich AG. The OeNB therefore records corresponding claims on the issuers in its books.

Schilling banknotes:

The exchange service that the OeNB offers for banknotes of the last Austrian schilling series issued before the euro changeover will be provided for an unlimited period of time. As the banknote-issuing institution, the OeNB is obligated to pay out the value of schilling banknotes in euro equivalents to the holders of banknotes. To provision for the schilling banknotes that have not yet been exchanged for euro, the OeNB established a provision for schilling banknotes without an exchange deadline. The provision is reflected under liability item 13.2 Other provisions.

What is special about the OeNB’s profit and loss account?

The OeNB prepares its profit and loss account in the format laid down by the Governing Council of the ECB, which accounts for the special requirements of central banks. As a result, the OeNB’s profit and loss account is not really comparable with profit and loss accounts of other corporations. The profit and loss account reports the OeNB’s revenues and expenses of the past business year. Two distinguishing features of the OeNB’s profit and loss account are, for instance, item 3 Net result of pooling monetary income and item 11 Banknote production services. Item 3 refers to the OeNB’s net profit/loss resulting from the reallocation of monetary income within the Eurosystem. Item 11 refers to expenses resulting from the purchase of euro banknotes from Austria’s banknote printer, the Oesterreichische Banknoten- und Sicherheitsdruck GmbH (OEBS).

Profits and losses of the OeNB: where do they come from?

In contrast to commercial banks, the OeNB does not operate with a view to making a profit. As part of the European System of Central Banks, the OeNB’s aims are to maintain price stability and to contribute to and implement the monetary policy of the Eurosystem. Monetary policy measures are reflected in the OeNB’s balance sheet. They may also cause the OeNB’s profit and loss account to fluctuate significantly over time. Accordingly, the OeNB may record profits or losses.

Profits of the OeNB

The distribution and use of the OeNB’s profit are subject to Article 69 Nationalbank Act. Up to 10% of the OeNB’s operating result after write-downs and provisions less corporate income tax (i.e. net profit) must be transferred to the pension reserve (until the pension reserve has reached the level required under Article 69 paragraph 2 Nationalbank Act). From the remaining net profit, the central government receives 90% plus, in a second step, a dividend of up to 10% of its 100% share of the OeNB’s capital, payable to the Federal Ministry of Finance.

Who decides how the OeNB’s profit is used? Where does any remaining profit go after the OeNB has paid out dividends?

How the OeNB’s profit is used is determined by the General Council of the OeNB following a recommendation by the Governing Board of the OeNB. The official decision is then adopted by the General Meeting of the OeNB.

Any remaining profit, which by decision of the General Meeting is to be carried forward as retained profit, is recorded in the balance sheet under item 16 Profit for the year.

Does the OeNB receive a share of the ECB’s profit and vice versa?

According to a decision by the Governing Council of the ECB, the Eurosystem NCBs, including the OeNB, are entitled to a proportion of the ECB’s income in the same financial year it accrues. The ECB’s profit is distributed in line with the shares the respective Eurosystem central banks hold in the ECB (relative capital key) and is shown in the OeNB’s profit and loss account under item 5 Income from equity instruments and participating interests.

Losses of the OeNB

The OeNB generates income from various sources, including interest received from loans to commercial banks and interest income on bonds purchased under the asset purchase programs of the ECB. The OeNB may face a loss if, for example, higher key interest rates cause its expenses for remunerating deposits from commercial banks to exceed the income it is able to generate with its portfolios of fixed-income, low-yield assets. This situation is called asset-liability mismatch.

What is the reason for the OeNB’s current losses?

To ease the risk of deflation stemming from global financial crises, central banks across the world, including the ECB and the Eurosystem national central banks, purchased fixed-income, low-yield private and public sector bonds with long maturities. The goal was to drive down market interest rates and achieve price stability.

Supply shortages and bottlenecks (due to the pandemic and Russia’s war of aggression against Ukraine, among other factors) caused inflation to go up markedly in recent years. By raising the key interest rates, the ECB managed to dampen inflation, aiming to reach its 2% target over the medium term. As a consequence of the increases in key interest rates, the OeNB must pay higher interest on bank deposits and therefore its interest expense has gone up markedly. This has affected the OeNB’s profit, causing the OeNB to temporarily experience losses. These losses will become smaller as the ECB’s asset purchase programs are winding down and reinvestments in low-yield securities for monetary policy purposes are being discontinued. The OeNB’s operating result will improve if income from its bond and other asset portfolios as well as from loans to banks rises or its holdings of bank deposits, or interest on these deposits, decrease.

Are losses a problem for the OeNB?

In line with their statutory mandate, the ECB and the OeNB maintain price stability over the medium term. Any profit or loss recorded is thus a corollary to the underlying mandate and the monetary policies adopted to fulfill this mandate.

Even when it records a loss, the OeNB is capable of fully and effectively fulfilling all of its tasks.

The OeNB is aware of the financial risks it itself bears. This is why, in the past, the OeNB retained earnings to build up financial buffers. In the face of financial risks or a negative operating result, the OeNB may resort to these reserves. Apart from that, the revaluation of specific OeNB assets likewise provides for buffers.

Does the Republic of Austria have to inject capital into the OeNB or does it have to compensate for any OeNB losses?

No, the central government, which is the sole owner of the OeNB, is not legally required to inject capital into the OeNB. Any balance sheet loss will be carried forward and offset by any future OeNB profits. During that time, no profit can be distributed by the OeNB to the central government.

How can the OeNB’s equity become negative?

Analogous to Article 225 paragraph 1 Commercial Code in conjunction with Article 229 Commercial Code, the OeNB’s equity is the sum total of its capital, free and earmarked reserves and the profit/loss for the year (including any profit/loss carried forward from the previous year).

In the balance sheet, equity turns negative once the loss for the year exceeds the sum total of capital and reserves. This can happen if the loss for the year and loss carryforwards from previous years exceed the amount of capital. It will take future profits to bring down multiyear losses over time.

Unlike commercial banks, the OeNB, like any other central bank, can operate for an extended period of time even with negative equity. This is because the assets of central banks tend to go far beyond their liabilities. These assets include, e.g., gold holdings, foreign reserve assets and other assets as well as revaluation assets, as recorded in liability item 14 Revaluation accounts. Taking into account all revaluation assets, they form the OeNB’s net equity.

How does negative equity affect the OeNB?

Given the singularity of central banks in the financial system, they are able to make payments and comply with their tasks even when their equity is negative. For the OeNB, and other central banks alike, safeguarding price stability and hence economic welfare is paramount – short-term profitability is of subordinate importance.