Off-site analysis

The core task of off-site analysis is to monitor the risks of supervised banks. To this end, the OeNB’s off-site analysis divisions have set up a comprehensive approach, using all available data and information to assess banks’ risks.

Data sources used comprise banks’ regulatory reporting data, any additional data received due to reporting obligations or from OeNB surveys, regular meetings with banks, on-site inspection reports, regulatory stress test results, recovery plans, annual reports and information from internal and external audit reviews.

At the OeNB, off-site analysis is guided by the principle of proportionality, which ensures that the intensity of analytical work is commensurate with the size and risk profile of each bank. While the Capital Requirements Regulation (CRR) defines “small and non-complex institutions”, within the Single Supervisory Mechanism (SSM) less significant institutions (LSIs) are in addition distinguished according to their risk profile and their potential impact on the domestic financial system, in line with the SSM Framework Regulation. Under the EBA’s Supervisory Review and Evaluation Process (SREP) guidelines, banks are divided into categories that determine the scope, frequency and intensity of each bank’s supervisory review process

What are the main tasks of supervisory analysis?

Supervisory analysis is guided by uniform principles and, as explained below, distinguishes between banks categorized as significant and less significant institutions (SIs and LSIs). All data that have been collected about individual banks are reviewed at least annually in the SREP, which assesses whether the bank’s capital and liquidity are adequate. To this end, banking supervisors in the off-site analysis division perform specific analyses that are used as a basis for setting bank-specific capital ratios (SREP ratios) and liquidity requirements.

Beyond issuing decisions specifying capital ratio requirements, the competent authorities may impose further supervisory requirements. For this purpose, in-depth and ad hoc analyses (e.g. on legal changes such as demergers or mergers) are performed, and internal models used by banks for risk assessment are reviewed. The follow-up process for on-site inspections is also carried out by the off-site analysis divisions. Based on their analyses, competent authorities can order banks to remedy any identified deficiencies and/or take measures to address structural weaknesses.

In addition to analyzing the operations of individual banks or specific sectors, supervisors perform in-depth reviews of selected banks (thematic reviews, deep dives and cross-functional analyses).

In carrying out their responsibilities, they are in constant exchange with the supervised credit institutions.

Off-site analysis of SIs

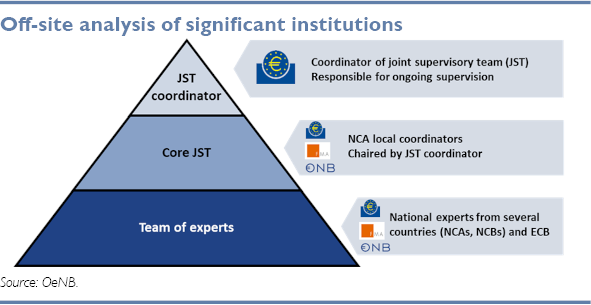

For those banks and banking groups operating in Austria which have been classified as SIs or are subsidiaries of SIs, ongoing supervision is carried out by Joint Supervisory Teams (JSTs). In carrying out their reviews, these teams apply common SSM methodologies and use common SSM formats. The OeNB’s division that analyzes SIs is part of the JSTs.

Off-site analysis of LSIs

In contrast to the situation with SIs, the ECB only has an oversight role in the supervision of LSIs. This means that national supervisory authorities are responsible for supervising individual LSIs. Compared to other SSM countries, Austria has a large number of stand-alone banks. Following international rules, the OeNB’s analysts apply the principle of proportionality and align their activities with a given bank’s size and risk profile.

To ensure efficient communication, supervisory processes and direct lines of responsibility, the OeNB and the Financial Market Authority (FMA) implemented a system of single points of contact (SPOC) for each supervised bank and sector. The work of the analysts is facilitated by automated systems that draw on reporting data.