Standardization and SEPA

Bank cards with integrated circuits – chips – have been used throughout Austria since 1995. Chips have made possible the introduction of new card functions, such as the electronic purse, and above all have ensured a consistently high level of security for bank cards in Austria. The chip contains all relevant information related to the card – balance, code, limit, expiration date and card cancellation. Card readers are used to read this information. Many countries have introduced integrated chip cards similar to those used in Austria.

However, as chip card technology was introduced on the basis of different national standards, the less secure magnetic stripe technology had to be used for processing cross-border payments. As a result, cross-border payments were plagued by many cases of card fraud. To address this problem, the large card schemes Europay, MasterCard and Visa (“EMV”) developed a harmonized technical standard for chip cards and payment processing, the EMV standard. EMVCo (owned by JCB Co. Ltd., MasterCard International and Visa International) has been founded to manage, maintain and enhance the EMV specifications. Cards stakeholders in the EU had nearly completed migration to the EMV standard by the beginning of 2012.

SEPA standardization

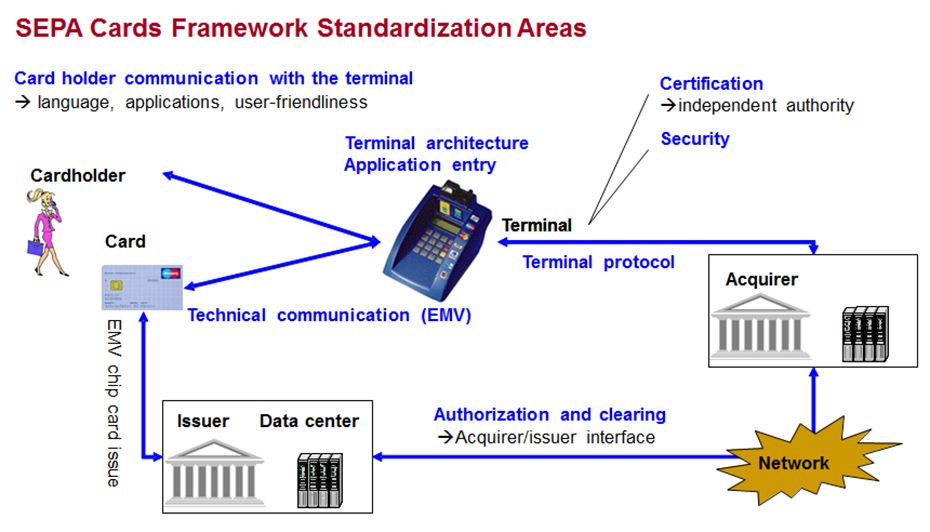

The objective of the Sepa Cards Framework is to establish interoperability, i.e. to create an EMV-compliant environment in which there are no technical, legal or economic barriers that would keep payment service providers and payment service users – card scheme owners, cardholders, issuers (card-issuing banks), acquirers (merchants’ acquisition bank) or merchants – from providing or using cross-border card payment services.

Directive 2007/64/EC on payment services in the internal market (Payment Services Directive, PSD) establishes a legal framework for payment services. The SEPA Cards Framework (SCF) of the European Payments Council (EPC) draws up a set of general principles and rules for card payments. The SCF covers payments with cards and cash withdrawals with cards within SEPA in euro or in the currencies of Member States that have decided to apply Regulation (EC) No 2560/2001 on cross-border payments in euro. The SCF does not apply to other card-based services, such as overdrafts. Moreover, the SCF is not applicable to electronic purses.

Unlike in the case of credit transfers and direct debits, no deadline for migration of card payments has been mandated by law.

Several areas have yet to be standardized to establish technical interoperability. The EPC Cards Working Group has been monitoring and coordinating the standardization efforts of various (independent) initiatives since autumn 2006.